Why Turnkey for Payment Orchestration?

Turnkey automates treasury operations, internal transfers, and crosschain routing through a single integration with sub-100ms signing and role-based-access-controls (RBAC) at every transaction. Keys stay secure in hardware-backed enclaves while your team gets full visibility into every fund movement.Core security principles

Turnkey’s solution is engineered to meet the operational and security needs of high-value, high-volume payment flows:- Zero exposure of private keys: Private keys are default-generated and isolated within Turnkey’s secure enclave, ensuring raw private keys are never exposed to employees, automated systems, or even to Turnkey itself.

- Strict access control (RBAC): Every action is explicitly permissioned in Turnkey’s Policy Engine. If an employee or automated system is not explicitly allowed to perform an action, they cannot.

- Predictable and flexible workflows: Policies allow for granular control over permissions based on transaction type, value, wallet properties, smart contract interactions, and more. This flexibility allows businesses to meet both automated and human-operator review requirements.

- Enhanced operational security: Workflows ensure that all transfers and actions come from known, authorized addresses, adding a layer of transparency and accountability to activity.

Example

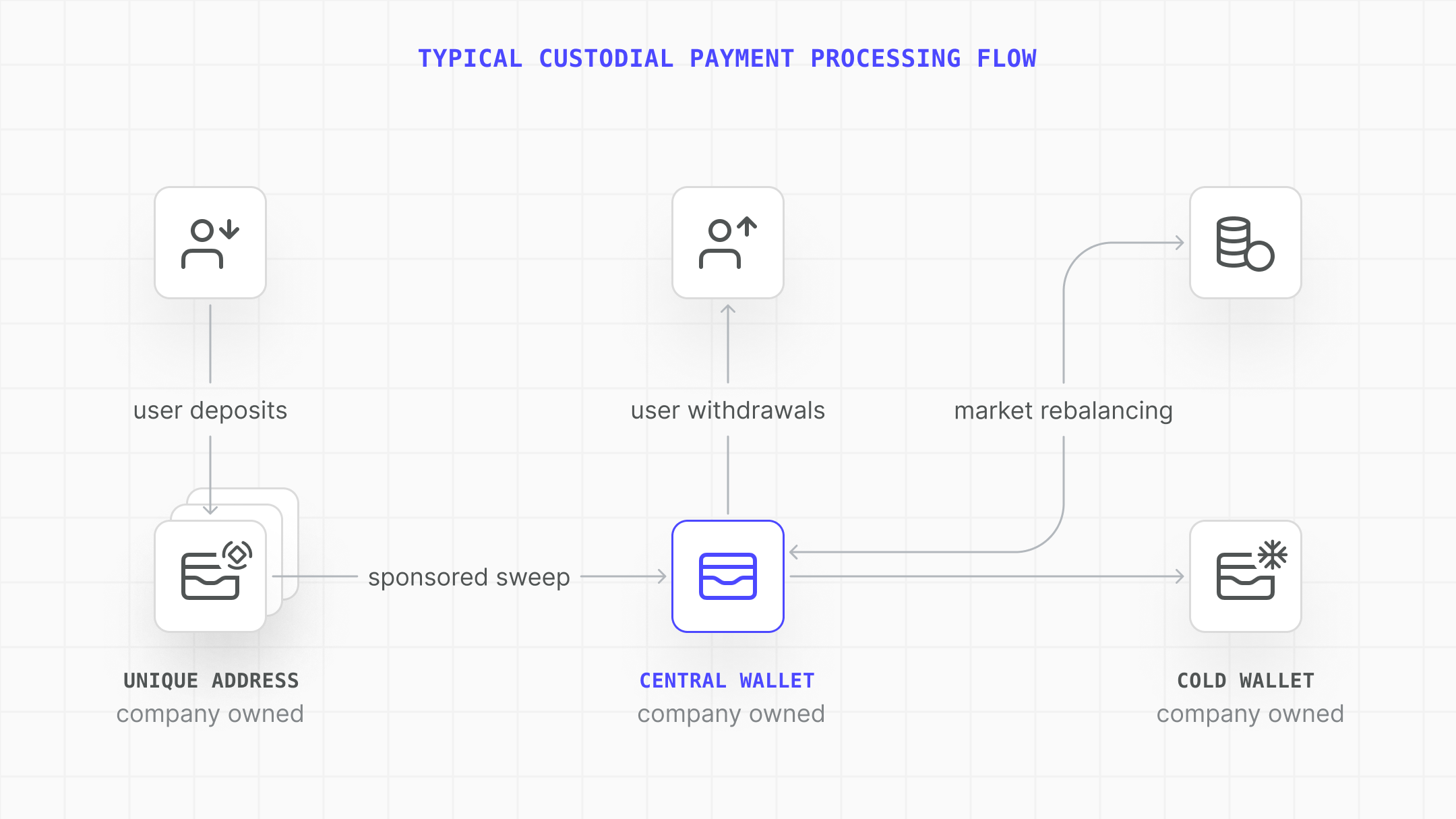

Exchanges and custodial payment processors are common examples requiring highly scalable, highly secure onchain systems.

| Need | Solution |

|---|---|

| All users have a unique deposit address | Wallet accounts are efficiently created and controlled within a Turnkey organization |

| Access to all wallets must be strictly permissioned | Policies enforce RBAC and least-privilege for all signing actions |

| Keys must never be exposed | Keys remain secure in secure enclave; only signatures are provided |

| Must support automation and human review | Policies can be written to allow automation for common tasks, or require multi-party consensus for sensitive ones |

| Must move funds efficiently | Transaction sponsorship makes it trivial to pay for only gas used on thousands of wallets |

How Turnkey smooths payment flows

Turnkey can help at every step to remove friction, accelerate time-to-value, and meet sophisticated requirements:Secure organization setup

The first step is to create a Turnkey Organization and populate it with users representing your team and automated workflows.

These users (human and machine) are assigned specific Policies dictating their access patterns to different wallets and onchain functions.Among these users, the Root Quorum holds the highest level of access as a group that

can execute any action and bypass the policy engine. By default, your initial user is the sole member. To prevent a single point

of failure, we recommend raising the Root Quorum to require multiple root users to approve the most sensitive organizational changes.

Deposit wallet creation

Turnkey allows you to create numerous wallet accounts at no cost, each with a unique address belonging to the same

underlying wallet resource. Before we can programmatically create an unlimited number of wallet accounts,

let’s create a “Deposits wallet” using the @turnkey/sdk-server Typescript SDK.Now we can create a function that produces a fresh EVM and SVM deposit address each time it’s called.Such a function could be connected to end-user action, or kicked off by some internal flow.

Hot wallet automations

Creating deposit addresses on demand is straightforward, but traditionally, the complexity begins after something is deposited.

Moving these funds to a company wallet after deposit (a “sweep”) is subject to major security and cost considerations. With Turnkey, we can:Turnkey’s Policy Engine is default-deny, so you only need to specify the exact conditions to allow.

Transactions must be fully parsed and validated against your policy parameters. Any raw or obfuscated payloads are rejected unless otherwise specified.A costly component of deposit wallet operations is funding each address with enough gas to cover the network fee for sweeping into

your central wallet. This funding transaction itself incurs a second fee.Thankfully, with a single line, we can enable Turnkey’s sponsored transaction feature and bypass this entirely, executing a single

optimized externally sponsored transaction.A more complete guide to gas sponsorship can be found here.

- Enforce that all transfers from deposit addresses are into a centrally controlled omnibus address.

- Forgo sending additional funds to every deposit address to cover transaction fees (gas).

Treasury wallet flows

At this point, we’ve covered creating deposit addresses on demand and securely sweeping funds to a treasury address.The next step is managing a wallet that likely requires human-operator approval and may need more sophisticated automations like asset rebalancing.To set multi-user approval in policies, create a user tag (e.g., ‘ops-team’) and apply it to your teammates. You can then set a policy requiring

their approval for transfers to a company cold wallet.When transferring tokens rather than native funds, the transaction data can be parsed for known function signatures (e.g., an ERC-20 transfer),

but the recommended approach is to upload the contract ABI for supported assets and act

on fully parsed transactions.Managing real assets at scale introduces security complexity. Balancing risk management, regulatory compliance, and maintaining enough

liquidity to meet ongoing withdrawal demand makes fund movement one of the hardest problems to engineer. While there’s no universal solution,

pairing application-specific users with tailored policies is the security posture adopted by leading Web3 teams.